AAR Reports Third Quarter Fiscal Year 2004 Results

WOOD DALE, Ill., /PRNewswire-FirstCall via COMTEX/ -- AAR (NYSE: AIR) today reported its third consecutive quarter of sales growth and improved profitability, with net sales of $161.2 million and net income of $3.0 million or $0.09 per share for the third quarter ended February 29, 2004. The results represent the highest quarterly sales, gross profit, operating income and net income since the events of September 11, 2001 and include the benefit of a lower effective income tax rate. For the third quarter of last fiscal year, the Company reported net sales of $157.0 million and net income of $0.7 million or $0.02 per share.

"We are pleased to report another quarter of sales and earnings growth. Demand for mobility products and performance based logistics services from government customers and their contractors remained strong during the period," said David P. Storch, President and CEO of AAR. "We have initiatives in place to increase sales through more long-term program activity and are focused on improving our operating margins and optimizing our asset efficiency. We've stepped up efforts to identify strategic customers for additional long-term sales programs, similar to the recently announced Avio and Vietnam Airlines programs. We're working to improve our operating margins through better labor utilization and materials management and by increasing the engineering and technical content in our products. Our prudent inventory acquisitions have resulted in improved asset efficiency for our parts trading operations, as evidenced by inventory turns of 3.2x for parts purchased since November 2001."

The year-over-year sales growth and improved profitability were driven primarily by record shipments of manufactured products that support the U.S. Military's mobility requirements, resulting in a 30.4% increase in sales for the Manufacturing segment. In the Inventory & Logistics Services segment, demand for logistics support services from government customers continued to grow. Overall sales in this segment declined 3.9% due primarily to the Company's strategy to de-emphasize low-margin new parts distribution sales. Sales in the Maintenance, Repair and Overhaul (MRO) segment were 4.9% lower compared with the prior year as the Company experienced lower sales of component repair services. The Company did, however, experience higher sales at its airframe maintenance facility.

The Company achieved higher margins during the third quarter, with gross profit margin increasing to 16.5% from 15.6% in the prior year and operating income increasing 34.3% versus the prior year. The Company also improved working capital turnover to 3.1x from 2.6x in the prior year and increased order backlog 2% during the quarter and 47% since the beginning of the fiscal year.

Upon completing its fiscal 2003 federal income tax return, the Company determined that it qualified for additional tax benefits of $0.6 million related primarily to its export activities. The Company also reviewed its expected income tax rate for fiscal 2004 and now expects that tax benefits related to current-year export activities will offset federal income tax expense for the year. Taking these items into account, the Company's net income tax benefit was $0.1 million for the third quarter of fiscal 2004.

During the quarter, the Company issued $75.0 million principal amount of 2.875% convertible notes due February 1, 2024. The senior, unsecured notes are convertible, under certain circumstances, into approximately 4.03 million shares of AAR common stock at a conversion price of $18.59 per share. "We are very pleased with this recent financing, which has enabled us to enhance our liquidity, lower our interest expense and increase our operating flexibility. This added financial flexibility enables us to support our businesses by providing resources to expand capabilities and capitalize on new market opportunities," Storch added. The Company used a portion of the proceeds to repurchase $35.0 million of accounts receivable which had been sold under its accounts receivable securitization facility, to repay $16.9 million of 8.00% notes prior to their maturity, and to repay $4.0 million outstanding under its revolving credit facility. The annual interest expense savings related to these debt repayments is approximately $1.3 million pre tax. The Company ended the quarter with $100.6 million of cash and available lines of credit. Subsequent to February 29, 2004, the Company repaid notes payable in the amount of $13.5 million.

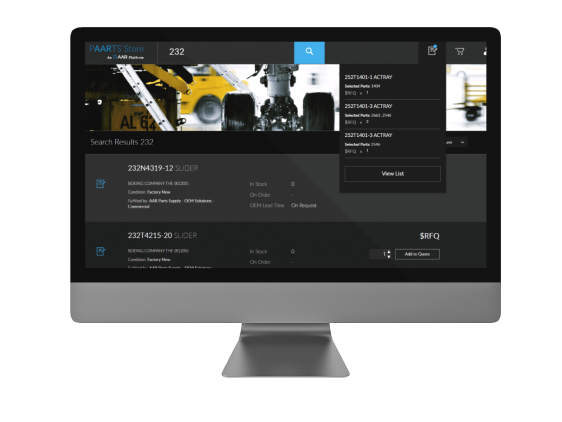

AAR (NYSE: AIR) is a leading provider of aftermarket support to the worldwide aviation/aerospace industry. Products and services include customized inventory management and logistics programs, encompassing supply, repair and manufacture of spare parts and systems. Headquartered in Wood Dale, Illinois, AAR serves commercial and government aircraft fleet operators and independent service customers throughout the world. Further information can be found at www.aarcorp.com .

AAR will hold its quarterly conference call at 10:30 AM (CST) on March 17, 2004. The conference call can be accessed via dial-in (1-913-981-5542; conference code 457532). A replay of the call will be available (1-719-457- 0820; conference code 457532) until 12:00 AM (CST) on March 23, 2004.

This press release contains certain statements relating to future results, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on beliefs of Company management, as well as assumptions and estimates based on information currently available to the Company, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated, including those factors discussed under Item 7, entitled "Factors Which May Affect Future Results", included in the Company's May 31, 2003 Form 10-K. Should one or more of these risks or uncertainties materialize adversely, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described. These events and uncertainties are difficult or impossible to predict accurately and many are beyond the Company's control. The Company assumes no obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. For additional information, see the comments included in AAR's filings with the Securities and Exchange Commission.

AAR CORP. and Subsidiaries

Comparative Statement of Operations

(In thousands except per Three Months Ended Nine Months Ended

share data) February 29/28, February 29/28,

2004 2003 2004 2003

(Unaudited) (Unaudited)

Sales $ 161,151 $ 156,992 $ 472,784 $ 461,208

Cost of sales 134,578 132,467 399,965 395,988

Gross profit 26,573 24,525 72,819 65,220

SG&A and other 19,172 19,016 58,322 59,240

Operating income 7,401 5,509 14,497 5,980

Interest expense 4,720 4,803 14,394 14,553

Interest income 284 296 1,200 1,049

Pretax income (loss) 2,965 1,002 1,303 (7,524)

Provision (benefit) for

income taxes (84) 351 (666) (2,633)

Net income (loss) 3,049 651 1,969 (4,891)

Earnings (loss) per

share-Basic $ 0.09 $ 0.02 $ 0.06 $ (0.15)

Earnings (loss) per

share-Diluted $ 0.09 $ 0.02 $ 0.06 $ (0.15)

Average shares

outstanding-Basic 32,168 31,846 31,999 31,852

Average shares

outstanding-Diluted 32,732 31,849 32,246 31,852

Balance Sheet Highlights February 29, May 31,

(In thousands except per share data) 2004 2003

(Unaudited) (Derived from

audited

financial

statements)

Cash and cash equivalents $ 48,885 $ 29,154

Current assets 437,750 396,412

Current maturities of recourse LTD 6,860 59,729

Current maturities of non-recourse LTD* 726 32,527

Current liabilities (excluding current

maturities of LTD) 122,791 111,319

Net property, plant and equipment 83,188 94,029

Total assets 721,229 686,621

Recourse long-term debt 229,598 164,658

Non-recourse long-term debt* 31,406 -

Stockholders' equity 297,471 294,988

Book value per share $ 9.23 $ 9.26

Shares outstanding 32,245 31,850

* The Company's non-recourse debt associated with an aircraft was

refinanced in January of 2004 with the maturity date extended to July of

2005. Accordingly, a portion of the non-recourse debt has been

classified as long-term.

Sales By Business Segment Three Months Ended Nine Months Ended

(In thousands - unaudited) February 29/28, February 29/28,

2004 2003 2004 2003

Inventory & Logistics Services $ 61,148 $ 63,654 $ 192,142 $ 190,151

Maintenance, Repair & Overhaul 49,899 52,496 156,324 151,810

Manufacturing 44,246 33,930 101,212 91,233

Aircraft & Engine Sales & Leasing 5,858 6,912 23,106 28,014

$ 161,151 $ 156,992 $ 472,784 $ 461,208

SOURCE AAR CORP.

Timothy J. Romenesko, Vice President, Chief Financial Officer of AAR, +1-630-227-2090, tromenesko@aarcorp.com

Related news

See all

November 26, 2024

AAR included among Forbes’ America’s Dream Employers 2025

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, has been recognized by Forbes as one of America’s Dream Employers 2025. This prestigious award is presented in collaboration with Statista, the world-leading statistics portal and industry ranking provider. The award list was announced late last week and can be viewed on Forbes’ website.

November 18, 2024

AAR releases 2024 Sustainability Report

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, released its 2024 Sustainability Report today, highlighting the continuation and advancement of the Company’s environmental, social, and governance commitments.

November 14, 2024

AAR signs exclusive global distribution agreement with Whippany Actuation Systems

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, has signed an exclusive multi-year distribution agreement with Whippany Actuation Systems, a TransDigm Group business.